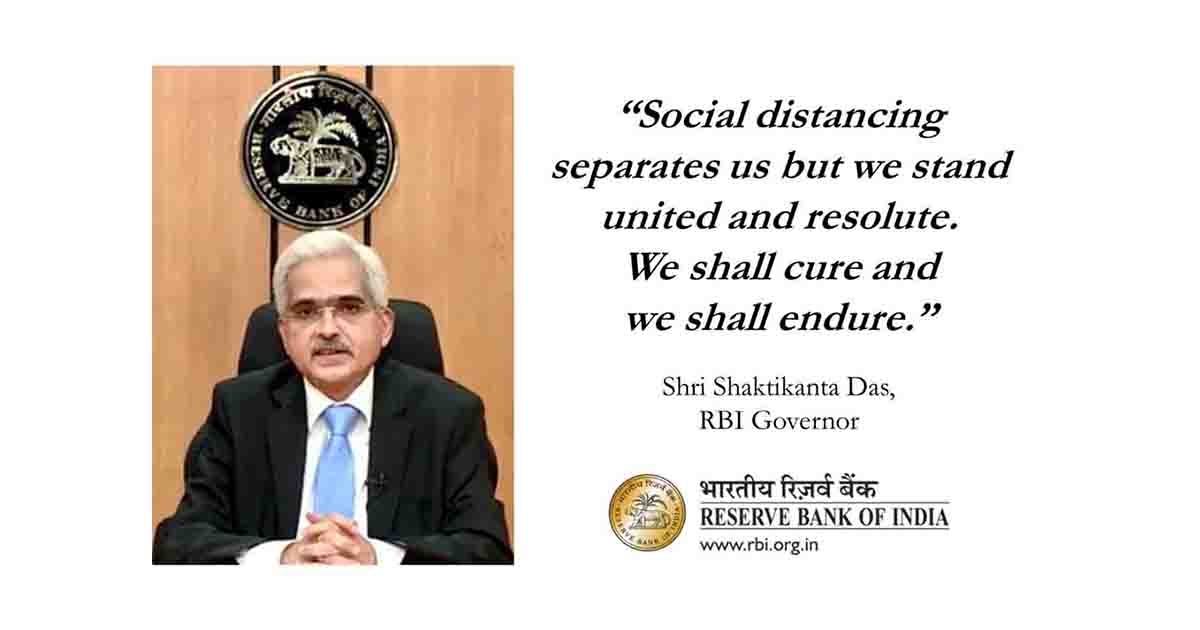

Today, the Governor of the Reserve Bank of India, Shaktikanta Das addressed the nation announcing the measures to be taken to save the country from the pandemic fallout from the economic point of view.

Expressing his main concern about the maintenance of adequate liquidity in the system to ease the financial stress and ensure a smooth run of the market, the Governor issued new guidelines for the financial structure of India.

RBI Governor’s address to the media https://t.co/uhsojdIeSF

— ReserveBankOfIndia (@RBI) April 17, 2020

To meet the necessity of the country and to pull it out from the economic depression, RBI has announced to finance NABARD, SIDBI and NHB with INR 50,000 crores to support the rural banks, mico-industries, state housing banks and other micro businesses.

— ReserveBankOfIndia (@RBI) April 17, 2020

Apart from this, RBI has also increased the Way and Means Advances (WMA) limit by 60% over and above the limit as of 31 March. This facility will be available till September 2020. The WMA is the financial support that RBI provides the state banks to overcome the temporary difference in cash flow.

Also RBI has permitted lenders to grant a moratorium of loan payment which are due between 1 March to 31 May 2020. However, interest will be levied on the loan payments.

— ReserveBankOfIndia (@RBI) April 17, 2020